Financial planning is a crucial aspect of everyone’s life, regardless of age, income, or profession. Whether you are a student, a working professional, or a retired individual, managing your finances is essential to ensure a comfortable and stress-free life. Fortunately, there are several financial calculators available online that can assist you in planning your finances effectively.

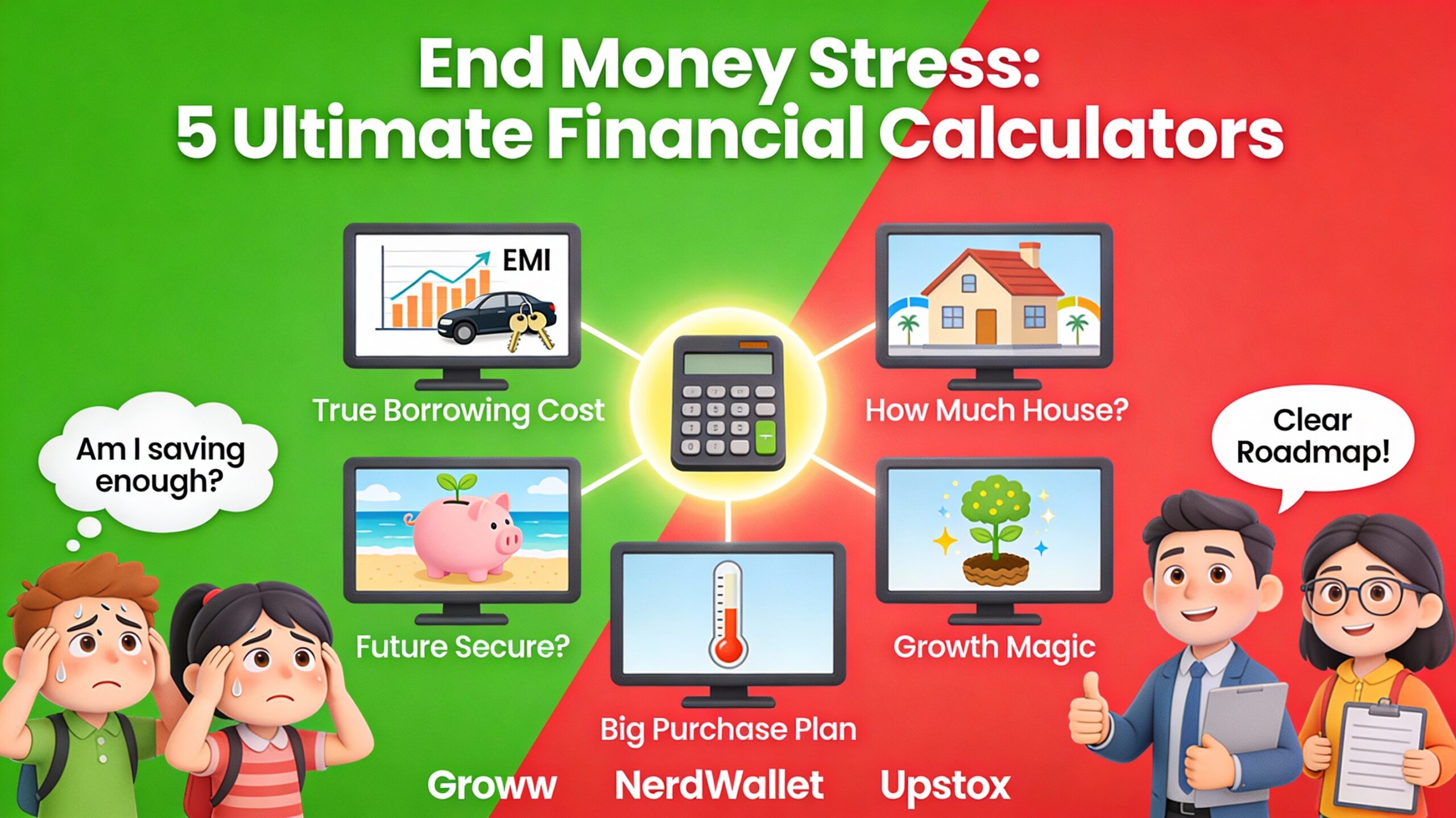

Without a clear plan, financial questions can create constant anxiety. You might wonder, “Am I saving enough for the future?” or “Can I truly afford this loan?” This uncertainty can be paralyzing, often leading to inaction or poor decisions. The goal of financial planning is to replace that stress with confidence, giving you a clear roadmap to follow. These tools are the first step on that journey.

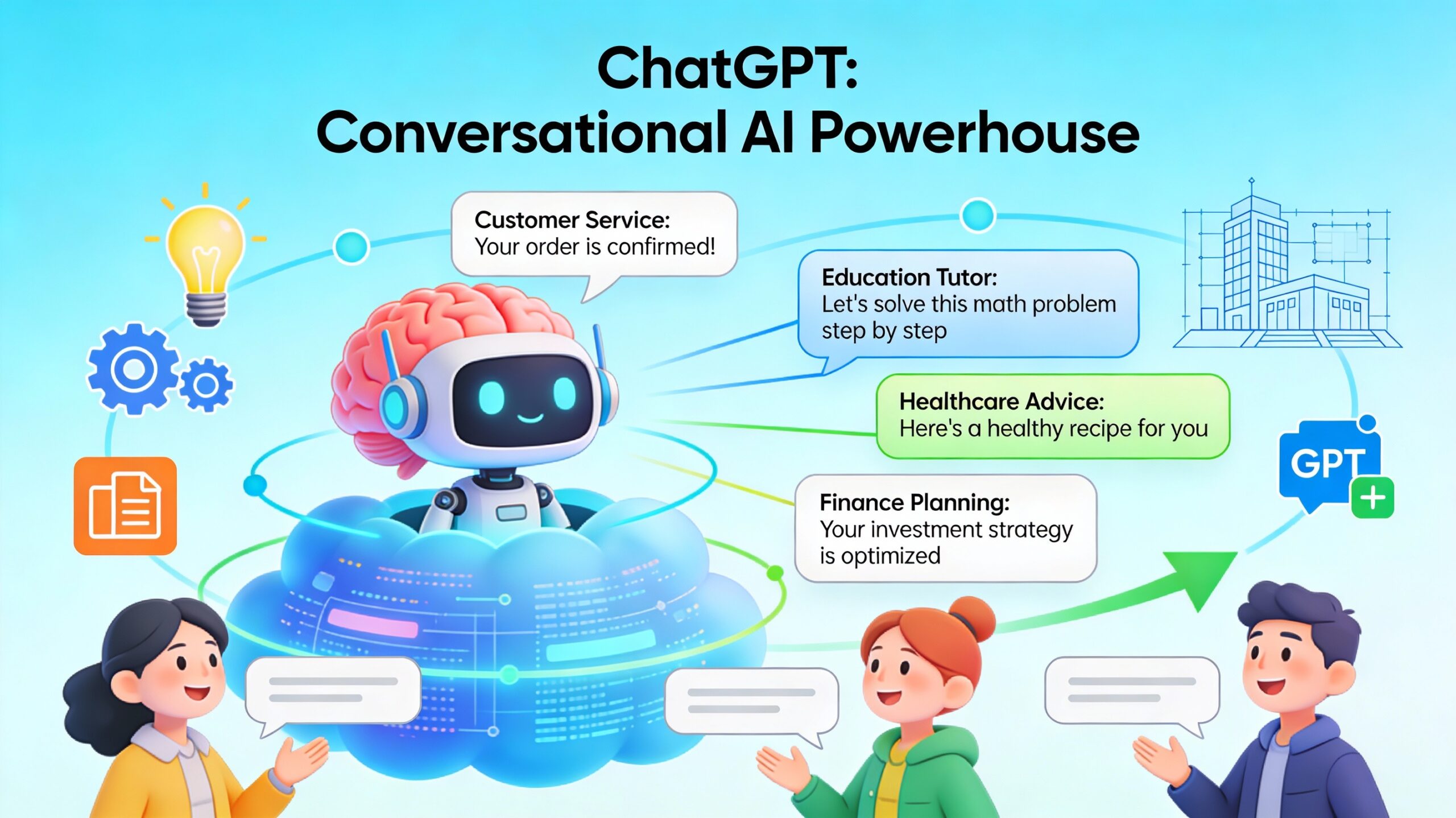

Financial calculators are online tools that allow you to calculate various financial parameters such as savings, investments, loans, mortgages, and retirement plans. These calculators are designed to make complex financial calculations simple, accurate, and hassle-free. With the help of financial calculators, you can evaluate different financial scenarios and make informed decisions about your money.

The true power of these calculators lies in their ability to demystify complex financial concepts. For instance, the impact of compound interest on your investments can be difficult to grasp, but a calculator can show you the incredible growth potential in seconds. They transform abstract goals into tangible numbers, empowering you to see exactly how your decisions today will shape your financial reality tomorrow.

To get the most out of these tools, it helps to know which calculator to use for your specific goal. A Loan Calculator is perfect for understanding the true cost of borrowing money for a car or personal expense. A Mortgage Calculator is essential for figuring out how much house you can afford. Meanwhile, a Retirement Calculator provides a long-term vision, helping you determine if your current savings strategy is on track for a comfortable future.

Here are some of the most popular financial calculators that you can use to plan your finances:

There are several websites and financial institutions that offer these calculators for free. Some of the popular websites include Bankrate, NerdWallet, and Investopedia. You can also find financial calculators on the websites of financial institutions such as banks, credit unions, and investment firms.

Getting started is easier than you think. You don’t need to tackle all your financial goals at once. Begin with the one area that is causing you the most concern. If debt is on your mind, start with a debt payoff calculator. If you’re dreaming of a big purchase, use a savings goal calculator. By taking one small, focused step, you can build momentum and confidence in your ability to manage your finances effectively.

In conclusion, financial calculators are valuable tools that can help you plan your finances effectively. By using these calculators, you can make informed decisions about your money, save more, invest smarter, and achieve your financial goals. So, if you want to take control of your finances, be sure to check out some of the calculators mentioned above and start planning today.

Visit: Ireava